Whether you like the large abstract paintings of Mark Rothko or not, there is no doubt that they are valuable. In 2012, a Rothko canvas fetched a record $87 million at an auction. A recent collection featuring other American Abstract Expressionists, including one work by Willem de Kooning and one on Jackson Pollock, set new records. The collection was sold for $500 million in one of the most expensive private art deals in history.

Visit BG Crafts Gallery and discover original paintings, unique sculptures, wood carvings, and other unique artworks by contemporary European artists!

“Orange, Red, Yellow,” 1961, sold by Christie's. Image credit: Stan Honda/Agence France-Presse — Getty Images

Such multi-million dollar deals are able to attract some opportunistic investors who are entering the art market for the first time. But investment experts and art curators alike warn prospective investors considering this potential asset class to be careful. Investing in art is not for the faint of heart.

The art market continues to thrive. It seems like every day another auction record for "highest price ever paid" is set.

The fine art market is fickle, and there are no guarantees of profitability, but with a little work and foresight, you can fill your home with paintings that can prove to be valuable assets in the future.

Did you know…? High-quality copies of original works are known as giclées. The more rare a work of art is, the more valuable it is. Engravings and posters are usually easily distinguishable with the naked eye, from the originals. Many people who buy paintings never resell them. This fact can greatly distort estimates of the value of given works of art. The best way to sell your collection for a decent price is with the help of an auction house, which specializes in selling works of art. The usual commission fee on an auction sale is about 5-25% of the selling price. If you sell it yourself, through an auction site, the costs are lower. Art is a long-term investment, and while the art market can be stable or show great returns on investment during economic booms, it is one asset whose value can quickly decline during periods of recession. |

Original ideas: Paintings and giclées

You walk into a gallery and fall in love with a $5,000 painting, but you can't stomach the price. The gallery owner shows you a selection of works by the same artist for a modest $500, explaining that the works are giclées. A giclée is a machine-made print, a reproduction printed on fine paper or canvas, with color, detail, and relief that can rival the original. But the bike still remains a copy.

The rarer a work of art is, the more valuable it is. So the original will always cost more than the reproduction. While a giclée may be described and qualified as "museum quality" or "archival," and the seller may boast a certificate of authenticity, it will never be as valuable as the original. Some artists and appraisers consider giclees to be for novice collectors.

Still, it cannot be denied that a giclée makes fine art accessible to many art lovers, and while the certificate does not add much value to the reproduction, the original signature and especially attached additional information (an original drawing made by the artist, such as a giclée) can increase future value.

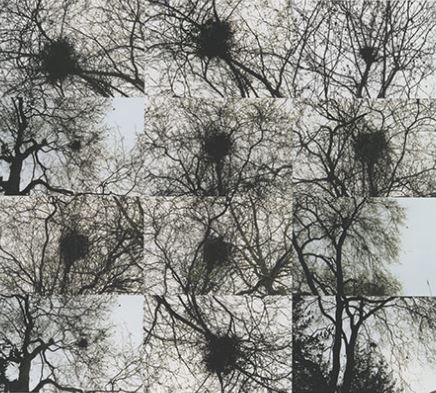

Of course, you may hear tales of giclées being proudly displayed in such noble institutions as The British Museum and The Metropolitan Museum of Art, but the works held in these collections are limited edition "Iris Print" digital images, or digital manipulations, such as "Nest and Trees" by Kiki Smith in "Metropolitan" e.g. They are not reproductions of original paintings.

Untitled (Nest/Trees), 1997, Stewart S. MacDermott Fund, 1999, The Met

Museums, however, sell masterpiece giclées to generate revenue. These giclées, while pleasing to the eye and your soul, will not bring you any future income.

Prints and Posters

In the middle of the 19th century, the company Currier & Ives brought art into the homes of Americans with their mass-produced posters. In the first half of the 20th century, a quarter of homes in the United States were decorated with prints of works by Maxfield Parish.

These images are the forerunners of the posters sold in malls, and museum shops, today. Posters, like giclee prints, give you access to masterpieces of art, but the poster is not of the quality of other fine art copies, which can be in the form of a hand-made screen print, lithograph, or woodblock print.

The most expensive painting ever sold is Leonardo da Vinci's Salvator Mundi, which was estimated and sold at auction for $475 million.

Photo Credit: Deutsche Presse-Agentur GmbH

Very often the original print, in the form of a painting, can be distinguished from a poster print with the naked eye. In some cases, however, you may need a magnifying glass or magnifying glass. The offset printing process leaves a small dot matrix on the paper.

Several factors determine the value of a work - the print run (ie, the number of prints an artist makes of a work), the significance of the work, the condition of the print, and whether it is signed, and numbered by the artist.

In the print market, value is determined by rarity. Small edition limited edition prints are more valuable than mass produced images. Even the first copies of the print have more value than anything that follows (for example, #10 of 100 is a much more valuable copy than #80 of 100).

Selling your Art

Many people who buy paintings never sell them. When a painting is sold at auction, it is often because the owner of the work thinks it will attract a good buyer, and sell for a high price. Auction prices affect the price of over 40% of art resold, and some experts estimate that only 0.5% of purchased paintings are ever resold.

If you have a real gem hanging on your wall, and are ready to part with it, your best chance of getting the best price is to sell it through an auction house. Commissions payable for auction sales are around 5-25 % of the sale price. Do-it-yourself auction sites usually charge lower commission rates.

Still, art is a long-term investment, and while the art market can be stable, or even promise gigantic returns during boom times, it's an asset that can easily decrease in value during periods of recession.

Latest Art Investing Tips

Gallery owners will tell you that buying art is an emotional decision, and this is true, if you are buying art without intentions to sell it. However, if you only view art as an investment, we suggest you explore all the living artists that catch your eye, learn more about their education, their commissions, and their exhibitions.

Visit the museums, galleries and cultural institutions in your area regularly, so that you can recognize potential emerging artists. Look for quality, and don't buy anything in poor condition. Who knows - you may be the lucky one to befriend the next Rothko, or discover a lost masterpiece worth millions!

Ready to Start Investing in Fine Art?

To start investing in fine art, one can visit online auctions, attend art fairs, invest in stocks, and buy art through an online gallery.

Visit BG Crafts Gallery and discover original paintings, unique sculptures, wood carvings, and other unique artworks by contemporary European artists!

5 TIPS FOR INVESTING IN ART Buy what you like The artwork you purchase will most likely be displayed in your home, or office, for years. First and foremost, make sure you like it. Explore art and artists Visit art galleries, museums, fairs, and artists' studios to determine what you like, and get an idea of the market value of art. Read articles by art critics, to discover emerging artists, and browse art prices from auction houses. Make contacts Build relationships with gallery owners, art critics, artists, and other collectors to educate yourself. Ignore fashion Buy art based on quality, not trends. And do your homework beforehand so you know the provenance of the art you're looking at. Don't limit yourself Artwork can take many forms off the canvas. Consider investing in other formats, such as art photography, handmade crafts, costumes, and archaeological objects. |

Are works of art a good investment?

YES, investing in fine art can be a good idea, but it is a bit risky.

Art that is rare and authentic is more valuable, especially if it is an original, and not a reproduction.

Specific art styles, themes and artists are more popular that others at any given moment, so time is always a factor as well.

Keep in mind that buying art involves additional costs, such as storage costs, insurance, commissions and taxes, to keep the art in good condition and to restore it.

When it comes to art, be sure to do some research, listen to your heart, and trust your sixth sense. We invite you to choose your next original work from the collection of BG Crafts Gallery.